Introduction

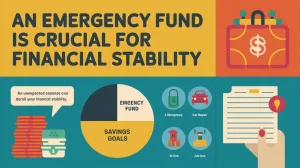

An emergency fund is one of the most vital components of a solid financial plan. It acts as a safety net, providing you with a cushion to handle unforeseen expenses without resorting to debt.

Emergencies like medical bills, car repairs, or job loss can strike at any time, and having an emergency fund in place ensures that these unexpected events don’t derail your long-term financial stability. But before you tap into this fund, it’s essential to pause and reflect.

Ask yourself three critical questions to ensure you are using the fund wisely and protecting your future financial health.

Why is an Emergency Fund Critical for Financial Stability?

Your emergency fund is not just a luxury—it’s a necessity. Without it, any financial hiccup can force you into a cycle of debt that could take years to break.

When you have savings set aside specifically for emergencies, you protect yourself from needing to use high-interest credit cards, personal loans, or depleting your retirement savings.

A well-managed emergency fund can provide peace of mind, knowing that you are prepared for life’s uncertainties.

Building an emergency fund is a foundational step toward financial independence. Experts recommend having at least three to six months’ worth of living expenses saved.

This buffer allows you to handle a sudden job loss, medical emergency, or any other significant financial strain. However, knowing when and how to use this fund is just as important as having it. Misusing it can set you back and jeopardize your long-term financial goals.

When Should You Tap Into Your Emergency Fund?

It’s tempting to use your emergency fund for any unexpected expense, but not every unplanned situation qualifies as a true emergency.

Before withdrawing from your emergency savings, consider the nature of the expense and its long-term impact on your finances. Is this an absolute necessity, or is there another way to manage the cost?

Understanding the proper use of your emergency fund can prevent financial regrets later on.

Question 1: Is This Truly an Emergency?

The first and most important question you should ask is, Is this truly an emergency? Emergencies are unexpected events that require immediate attention and financial action. Common examples include sudden medical issues, necessary home repairs, or losing your job. These are situations that, if left unaddressed, could have serious consequences.

On the other hand, some expenses might feel urgent but don’t truly qualify as emergencies. A last-minute vacation, upgrading your gadgets, or even routine car maintenance shouldn’t be covered by your emergency fund. These costs, while unexpected, are not urgent enough to justify tapping into the fund.

Knowing the difference between a true emergency and a non-essential expense can help you safeguard your emergency savings for when you truly need it. It’s a tool meant to provide financial security, not a quick-fix fund for impulse spending.

How to Identify a True Emergency

- Unexpected Medical Expenses: Hospital bills, surgeries, or medication costs not covered by insurance.

- Urgent Home Repairs: For example, fixing a leaking roof or a broken furnace during winter.

- Job Loss: A complete loss of income is a prime example of when to rely on your emergency savings.

Each of these scenarios presents a situation where failure to act could lead to severe consequences—either financial or otherwise.

Question 2: Can I Cover This Expense with Another Source of Funds?

Before tapping into your emergency fund, ask yourself, Can I cover this expense with another source of funds? If you have other ways to manage the cost, whether through a high-interest savings account, a short-term loan from family, or cutting back on non-essential spending, it might be better to preserve your emergency fund for a more dire situation.

Some alternatives could include:

- Reallocating Savings: If you have multiple savings accounts, see if you can temporarily divert funds from a less critical goal to cover the expense.

- Utilizing a Side Income: If you have a side hustle or can pick up extra work, consider using those earnings to cover the emergency.

- Negotiating a Payment Plan: For medical or large bills, many providers offer installment payment options.

Having multiple financial strategies can help you avoid prematurely draining your emergency savings. The more options you explore, the less likely you are to jeopardize your long-term security by using funds meant for true emergencies.

Question 3: Will Using My Emergency Fund Jeopardize My Long-Term Goals?

Another critical question to ask is, Will using my emergency fund jeopardize my long-term goals? Your emergency fund should act as a safeguard, but if tapping into it leaves you unable to meet important milestones—like saving for a home, retirement, or your children’s education—it may be better to seek alternative ways to cover the expense.

Let’s say you use a significant portion of your emergency fund to pay for car repairs. How will that impact your ability to recover financially if you suddenly lose your job? If using your emergency fund puts your broader financial picture at risk, it’s worth reconsidering whether the expense is really an emergency or something that can be managed through other means.

Explain Why Making Payments on a Car is Such a Poor Financial Decision

For many, owning a car feels like a necessity. But financing a car through monthly payments can be a financially draining choice. Why? Because cars are depreciating assets—they lose value the moment they leave the dealership. Meanwhile, you’re still locked into payments that include not only the car’s price but interest, insurance, and maintenance costs.

Here’s why making car payments is such a poor financial decision:

- Depreciation: Most cars lose 20-30% of their value in the first year alone, meaning you’re paying for an asset that’s worth far less than what you owe.

- Interest Charges: Financing a vehicle means you’re also paying interest on the loan, which increases the total cost of the car far beyond the sticker price.

- Opportunity Cost: Every dollar spent on a car payment is a dollar that could have been invested elsewhere, such as a high-yield savings account or stock market, where your money could grow over time.

How Does Planning and Saving for Your Future Help You Build Wealth?

Long-term wealth-building requires strategic planning and disciplined saving. By establishing a habit of regularly contributing to savings, you allow your money to grow over time, particularly through the power of compound interest. Planning and saving for your future help you build wealth by giving your money the chance to earn more money.

The Power of Compound Interest

One of the most effective ways saving helps build wealth is through compound interest. Compound interest is when the interest you earn on your savings or investments starts earning interest on itself. Over time, this creates exponential growth. Even small, consistent contributions to a savings or investment account can grow significantly with compound interest, making time your biggest asset in wealth-building.

For example:

- If you invest $5,000 per year in an account that earns 7% annually, in 20 years, you could have nearly $200,000. That’s the magic of compound interest!

Strategic Investments for Long-Term Growth

In addition to saving, investing your money in assets that grow over time, such as stocks, bonds, or real estate, can accelerate wealth-building. Diversifying your investments helps manage risk while maximizing returns, giving you a stronger financial foundation over the years.

What Struggles or Victories Have You Experienced When it Comes to Saving Money?

Everyone faces financial struggles at some point. Whether it’s dealing with unexpected expenses, overcoming bad spending habits, or reaching a major financial goal, these experiences shape your financial journey.

Being aware of these struggles—and celebrating your victories—can help keep you on track toward achieving long-term financial success.

Frequently Asked Questions (FAQs)

FAQ 1: How Much Should I Have in My Emergency Fund? You should aim to save at least three to six months’ worth of living expenses in your emergency fund.

FAQ 2: What Should I Do if I Need to Use My Emergency Fund? If you need to use your emergency fund, focus on replenishing it as soon as possible by adjusting your budget or finding new income sources.

FAQ 3: Is Leasing a Car Better Than Making Payments on a New One? Leasing can be a good option for those who want a new car every few years, but it can also result in higher long-term costs.

FAQ 4: What are the Best Ways to Save for Long-Term Goals? Utilize high-yield savings accounts, IRAs, and brokerage accounts to maximize your savings for long-term goals.

FAQ 5: Can I Build Wealth Without a High Income? Yes, by prioritizing saving, reducing debt, and making smart investments, even modest earners can build significant wealth over time.

FAQ 6: How Do I Stay Motivated to Keep Saving? Set specific, achievable goals, celebrate small wins, and remind yourself of the financial freedom that comes with disciplined saving.